German Deception

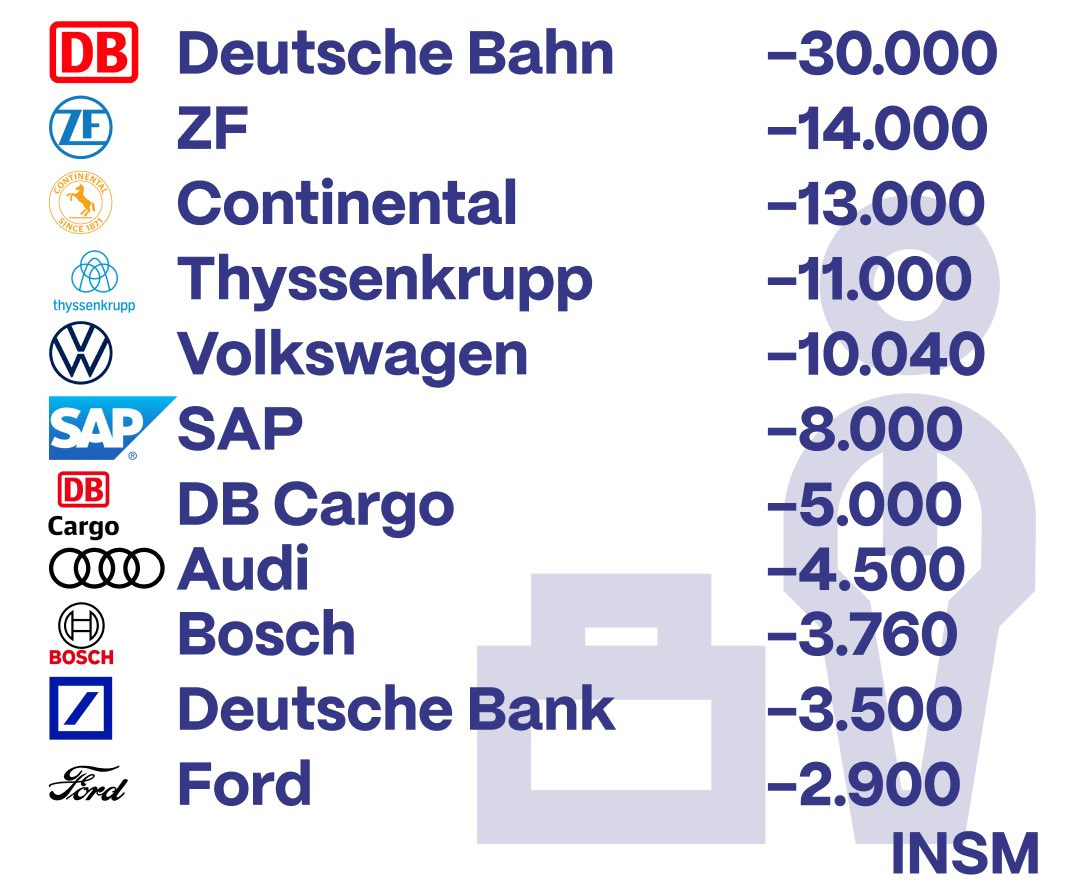

As DAX Index marks its all-time high, German economy is in a deep crisis. What has caused this dichotomy?

Memorable days we are witnessing. New all-time highs in the DAX Index are being reached, exceeded and updated every day. Is everything perfect?

Apparently yes but let's dig deeper.

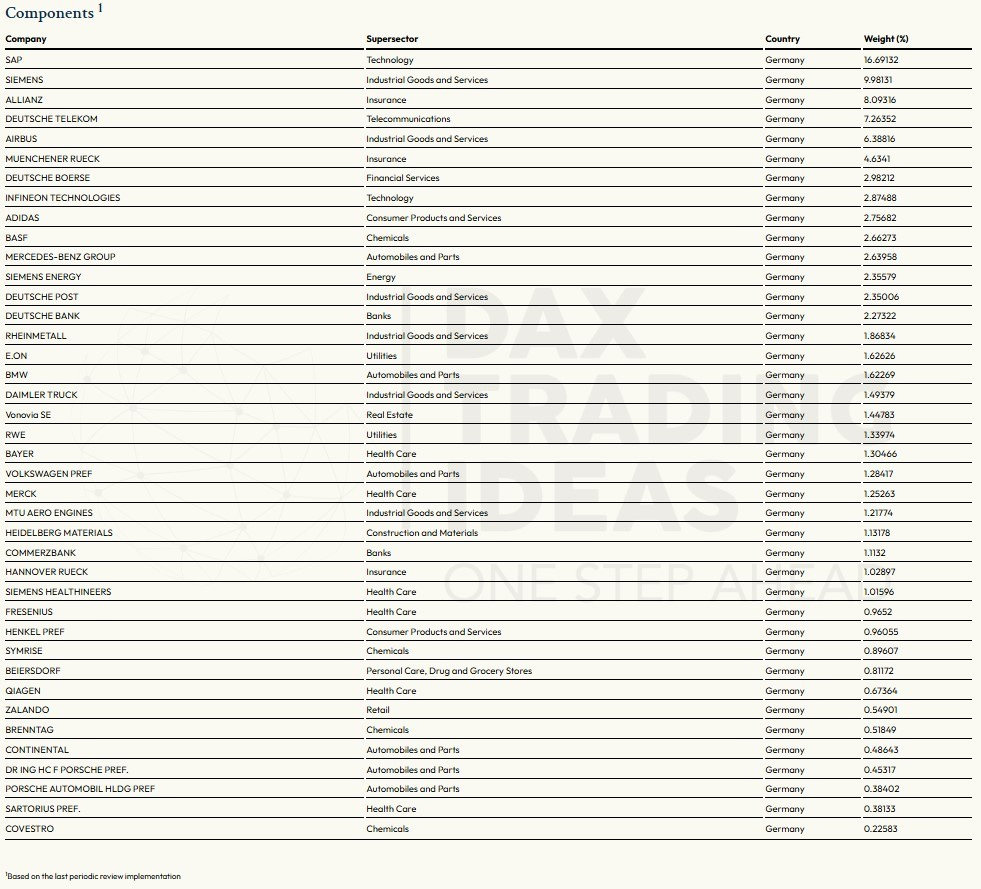

The DAX, which stands for Deutsche Aktienindex, takes into account the performance of the 40 largest companies listed on the regulated market of the Frankfurter Wertpapierbörse (FWB®, the Frankfurt Stock Exchange) meet certain minimum quality and profitability requirements. Component selection is based on free float market capitalization. DAX is calculated primarily as a performance Index and is therefore one of the few major country indices also takes dividend yields into account, thus fully reflecting the actual performance of an investment in the index portfolio. Basic criteria for the inclusion of companies in the DAX are:

existing listing on the regulated market of the FWB

continuous trading on Xetra®

minimum free float of 10%

registered or operational headquarters in Germany

timely publication of annual financial reports

certified semi-annual and quarterly

To be included in the DAX, a company that is not yet an index component must meet the following minimum FWB liquidity requirement: minimum order book volume in the past 12 months of €1 billion or turnover rate of 20%. A company that is already an index component must have a minimum FWB order book volume in the past 12 months of at least €0.8 billion or a turnover rate of 10%. In addition, to be eligible for the DAX, companies are not components at time of ranking must have positive EBITDA for the past two fiscal years. The selection of index constituents is based on free float market capitalization, and their composition is reviewed quarterly under Fast Exit and Fast Entry rules and semi-annually under Regular Exit and Regular Entry rules. Index weighting of a single stock is limited to 10%.

Here the first doubt arises: as we saw in the Annual Outlook, the first stock by capitalization is SAP SE with over 15.43%. If valuations of the other 39 stocks are within 10%, why was this company allowed to rise so much in the space of one year? (SAP went from just over 9% to over 15%, ed.).The second doubt or problem is related to legal operating headquarters in Germany.

As we know, currently most of the basket companies have relocated facilities, both in terms of production and as the base of the company's main activities. The so-called «center of business», that is, where administrative management of the company takes place, is almost entirely outside of Germany, both because the products and services offered are sold all over the world and because the headquarters of these big companies, are located in the various off-shore branches.

Mystery hovers, and those who wrote the rules should be held accountable. Do these in fact, apply to everyone or were special criteria used?

Giornate memorabili quelle a cui stiamo assistendo. Ogni giorno vengono raggiunti, superati e aggiornati nuovi massimi storici dell’indice DAX.

Tutto perfetto? Apparentemente si ma scaviamo a fondo.

Il DAX, acronimo di Deutsche Aktienindex, tiene conto della performance delle 40 maggiori società quotate sul mercato regolamentato della Frankfurter Wertpapierbörse (FWB®, la Borsa di Francoforte) che soddisfano determinati requisiti minimi di qualità e redditività. La selezione dei componenti si basa sulla capitalizzazione di mercato del flottante. Il DAX è calcolato principalmente come indice di performance ed è quindi uno dei pochi indici dei principali Paesi che tiene conto anche dei rendimenti da dividendi, riflettendo così appieno la performance effettiva di un investimento nel portafoglio dell'indice. I criteri di base per l'inclusione delle società nel DAX sono:

quotazione esistente sul mercato regolamentato della FWB

negoziazione continua su Xetra®

flottante minimo del 10%

sede legale o operativa in Germania

pubblicazione tempestiva di relazioni finanziarie annuali

semestrali e trimestrali certificate

Per essere inclusa nel DAX, una società che non è ancora una componente dell'indice deve soddisfare il seguente requisito minimo di liquidità FWB: volume minimo del portafoglio ordini negli ultimi 12 mesi di 1 miliardo di euro o tasso di turnover del 20%. Una società già componente dell'indice deve avere un volume minimo di portafoglio ordini FWB negli ultimi 12 mesi di almeno 0,8 miliardi di euro o un tasso di rotazione del 10%. Inoltre, per essere ammesse al DAX, le società che non sono componenti al momento della compilazione della graduatoria devono presentare un EBITDA positivo negli ultimi due esercizi. La selezione dei componenti dell'indice si basa sulla capitalizzazione di mercato del flottante e la loro composizione viene rivista trimestralmente in base alle regole di Fast Exit e Fast Entry e semestralmente in base alle regole di Regular Exit e Regular Entry. La ponderazione dell'indice di una singola azione è limitata al 10%.

Qui sorge il primo dubbio: come abbiamo visto nell’Outlook annuale il primo titolo per capitalizzazione è SAP SE con oltre il 15,43%. Se le valutazioni degli altri 39 titoli sono comprese all’interno del 10%, perchè è stato concesso a questa azienda di lievitare così tanto nel giro di un anno? (SAP è passata da poco più del 9% a oltre il 15%, ndr). Il secondo dubbio o problema è relativo sede legale operativa in Germania. Come sappiamo, attualmente la maggior parte delle aziende che compongono il paniere, hanno strutture delocalizzate, sia in termini di produzione che come base delle principali attività dell’azienda. Il cosiddetto «centro degli affari», ovvero dove avviene la gestione amministrativa della società, è quasi del tutto al di fuori della Germania, sia perchè i prodotti e servizi offerti vengono venduti in tutto il mondo sia perchè le sedi di questi big companies, sono dislocati nelle varie succursali off-shore.

Il mistero aleggia e bisognerebbe chiederne conto a coloro che hanno scritto le regole. Queste infatti, valgono per tutti o sono stati utilizzati dei criteri speciali?

The dividend trick and economic crossroads

The other deception involves dividends. In fact, DAX Index has been in the window for the entire year since its inception. To put things in perspective, without dividends the index would be at 2000s levels, incorporating no significant price increases within the basket of German blue chips. Truly a staggering figure. But then what are we to believe, dividends or net assets? Let's say that allocation criteria within the index are very strict but also impose a pedigree on the part of participants: this causes, as is already the case with the Dow Jones Industrial Average, these sectoral baskets to be tweaked upward to always show the best companies in the market.

The logic of buying and selling and opportunism on which the markets are based would actually dictate different mechanisms, but we know the companies control the exchanges of major financial centers must produce profits and show attractiveness to retail customers and large institutions. There is no what is better and what is worse, we need to be able to recognize the context in which we are working. But that is not all, as Germany's economic scenario is at a crucial crossroads.

With only a few weeks to go before Germany's early elections, there is an urgent need to address some structural challenges that are straining one of Europe's most important economies. The post-Merkel political transition and the economic stagnation of recent years call for strategic thinking on three key issues, namely energy, exports and competitiveness.

Il trucco dei dividendi e il bivio economico

L’altro inganno riguarda i dividendi. L’indice DAX infatti è in vetrina per tutto l’anno, dalla sua nascita. Per mettere le cose in prospettiva, senza dividendi l’indice risulterebbe sui livelli degli anni 2000, non inglobando nessun aumento significativo di prezzo all’interno del paniere delle blue chip tedesche. Davvero un dato sconcertante. Ma allora a cosa dobbiamo credere, ai dividendi o agli asset netti? Diciamo che i criteri di assegnazione all’interno dell’indice sono molto rigidi ma impongono anche un pedigree da parte dei partecipanti: questo fa si che, come accade già al Dow Jones Industrial Average, questi panieri settoriali vengano ritoccati al rialzo per mostrare sempre le migliori compagnie sul mercato.

Le logiche di compravendita e di opportunismo su cui sono fondati i mercati in realtà imporrebbero meccanismi diversi ma sappiamo bene che le aziende che controllano le borse delle principali piazze finanziarie debbano produrre utili e mostrare attrattiva per clienti al dettaglio e grosse istituzioni. Non c’è cosa è meglio e cosa è peggio, bisogna saper riconoscere il contesto in cui stiamo lavorando. Ma non è tutto, poiché lo scenario economico della Germania è a un bivio cruciale.

A poche settimane dalle elezioni anticipate in Germania, emerge con urgenza la necessità di affrontare alcune sfide strutturali che stanno mettendo a dura prova una delle economie più importanti d’Europa. La transizione politica post-Merkel e la stagnazione economica degli ultimi anni richiedono una riflessione strategica su tre temi chiave, ovvero energia, esportazioni e competitività.

The future is now

Germany has made significant progress in the green transition, with more than 60% of its energy produced from renewable sources. However, the accelerated closure of nuclear power plants and the end of cheap gas supplies from Russia have tripled costs since 2019, making the German industrial system less competitive with other advanced economies. Although the energy transition is a model for other countries, significant challenges remain related to costs, stability of renewable supplies, and increasing energy demand.

In terms of exports, for years China has been a crucial market for German companies, particularly in manufacturing. However, with the rise of «Made in China 2025» strategy, the red dragon has become a direct competitor in key sectors such as automotive and advanced technologies. Reduced Chinese demand for German products and Asian country's growing industrial autonomy pose a strategic challenge to the German economic model.

In addition, Germany has experienced a significant decline in international competitiveness rankings, falling from the Top 5 in the 2010s to positions between 20th and 25th. Factors such as deteriorating infrastructure, lack of public and private investment, and low digitization have contributed to this situation. The investment gap is estimated at between 400 billion and 600 billion euros, a deficit that weighs on economic growth and the country's attractiveness for foreign investment.

Despite the challenges, Germany remains one of the most advanced and wealthiest economies in the world, with potential for significant recovery. Measures needed include cutting red tape, tax incentives to stimulate investment, action to lower energy costs, and an ambitious plan to modernize physical and digital infrastructure. These interventions will not only rejuvenate the German economic model, but also provide investment opportunities in key sectors such as renewable energy, advanced technologies and digital infrastructure. Competition with economies such as China and the United States will be challenging, but Germany is well positioned to emerge stronger.

We urge you to closely watch economic policy developments and post-election developments, which will be crucial in shaping Germany's economic and industrial future.

Il futuro è ora

La Germania ha compiuto notevoli progressi nella transizione verde, con oltre il 60% dell’energia prodotta da fonti rinnovabili. Tuttavia, l’accelerazione della chiusura delle centrali nucleari e la fine delle forniture di gas a basso costo dalla Russia hanno triplicato i costi dal 2019, rendendo il sistema industriale tedesco meno competitivo rispetto ad altre economie avanzate. Sebbene la transizione energetica rappresenti un modello per altri Paesi, rimangono sfide significative legate ai costi, alla stabilità delle forniture rinnovabili e all’incremento della domanda energetica.

Per quanto riguarda le esportazioni, per anni la Cina è stata un mercato cruciale per le aziende tedesche, in particolare per l’industria manifatturiera. Tuttavia, con l’ascesa della strategia «Made in China 2025», il dragone rosso è diventato un diretto concorrente in settori chiave come l’automotive e le tecnologie avanzate. La riduzione della domanda cinese di prodotti tedeschi e l’autonomia industriale crescente del Paese asiatico rappresentano una sfida strategica per il modello economico tedesco.

Inoltre, la Germania ha registrato un declino significativo nelle classifiche internazionali di competitività, passando dalla Top 5 degli anni 2010 a posizioni comprese tra il 20° e il 25° posto. Fattori come il deterioramento delle infrastrutture, la carenza di investimenti pubblici e privati, e la mancata digitalizzazione hanno contribuito a questa situazione. Il gap di investimenti è stimato tra 400 e 600 miliardi di euro, un deficit che pesa sulla crescita economica e sull’attrattività del Paese per gli investimenti stranieri.

Nonostante le sfide, la Germania rimane una delle economie più avanzate e ricche del mondo, con il potenziale per una ripresa significativa. Le misure necessarie includono la riduzione della burocrazia, incentivi fiscali per stimolare gli investimenti, interventi per abbattere i costi energetici e un piano ambizioso di modernizzazione delle infrastrutture fisiche e digitali. Questi interventi non solo ringiovaniranno il modello economico tedesco, ma offriranno anche opportunità di investimento in settori chiave come le energie rinnovabili, le tecnologie avanzate e le infrastrutture digitali. La competizione con economie come quella cinese e statunitense sarà impegnativa, ma la Germania è ben posizionata per emergere più forte.

Vi invitiamo a osservare con attenzione l’evoluzione delle politiche economiche e gli sviluppi post-elettorali, che saranno cruciali per definire il futuro economico e industriale della Germania.

I can't believe to see my country in such a bad shape and the DAX so high