The Long-Term Investor

Annual return of the S&P500 was worse than this year, index returned more than 20% in the following year

What a crazy year was 2022? Hello folks and welcome back here on Dax Trading Ideas. This past year we didn't miss a thing: war, famine, energy crisis, recessions, you name it. Stock markets closed with a negative sign as picture of the world's economic super-powers was being rewritten. In the first letter of the year we will focus on what could be, trying not to rage as Dmitry Medvedev did with his forecasting masterpiece (link here). To still exist after a global pandemic, steep descents, sensational climbs is truly heroic. We will try to do it again in 2023, hoping it will be as benevolent as the year just passed. Casting a glance at what we see around among analysts at the major business houses, new year could be one of redemption with Deutsche Bank and Fundstrat predicting a close between 4.500 and 4.750 S&P500. French are more pessimistic, with Societe Generale and BNP Paribas seeing clouds and target rates between 3.650 and 3.400. It will also be the year of Federal Reserve’ pivot, we will make (hard) recession official, and continue with chess game of war at the expense of Ukrainian people. Question will be to be able to understand how much all this will impact on markets. Let's dig in.

In this episode: After a down year | 2022, an anomalous year | Planetary cyclical index

Che anno pazzesco è stato il 2022? Salve gente e bentornati qui su Dax Trading Ideas. Quest’anno appena trascorso non ci siamo fatti mancare niente: guerra, carestie, crisi energetica, recessioni e chi più ne ha più ne metta. I listini azionari hanno chiuso con il segno negativo, mentre il quadro delle super-potenze economiche del mondo veniva riscritto. Nella prima lettera dell’anno ci focalizzeremo su quello che potrebbe essere, cercando di non infierire come ha fatto Dmitry Medvedev con il suo capolavoro previsionale (link qui). Esistere ancora dopo una pandemia mondiale, ripide discese, salite sensazionali è davvero da eroi. Cercheremo di farlo anche nel 2023, nella speranza che sia benevolo come l’anno appena trascorso. Buttando un occhio a quello che si vede in giro tra gli analisti delle principali case d’affari, il nuovo anno potrebbe essere quello della riscossa con Deutsche Bank e Fundstrat che prevedono una chiusura tra 4,500 e 4,750 di S&P500. I francesi sono più pessimisti: Societe Generale e BNP Paribas scorgono nubi e target rate tra 3,650 e 3,400. Sarà anche l’anno dell’ormai celebre pivot della Federal Reserve, ufficializzeremo la recessione (dura) e continueremo con la partita a scacchi della guerra a discapito del popolo ucraino. Il punto sarà riuscire a capire quanto tutto questo impatterà sui mercati. Approfondiamo.

In questo episodio: Dopo un anno negativo | 2022, un anno anomalo | Indice ciclico planetario

After a bad year

The question everyone will ask is: what happens next? No one can have arrogance to be able to seriously answer this question. Inside this letter for traders and investors, we have often created monthly forecasts on the performance of German DAX index, structured trades (still ongoing), have a long-term view and much more. The adventure we have embarked on has all in all performed well despite fact that everyone out there is ready to hurl criticism. I just do it when I really have a contribution to make, and don't do it just to. Working with statistics in your favor is the real secret to surviving in the jungle of financial markets.

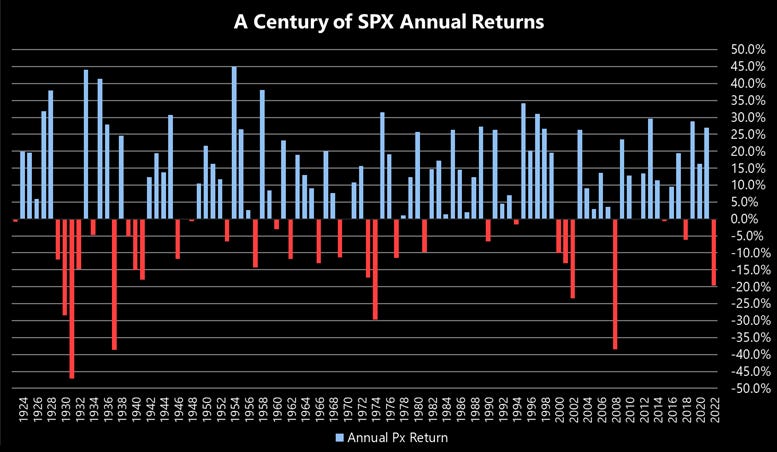

Analyzing the individual annual returns of S&P500 over the past 100 years, we found that although index's -20% or so annual return appears historically poor, we tend to see a rebound in the years following similar declines. That said, it is difficult to find one did not occur during or immediately after a recession. It is fair to point out that years of negative returns tend to be followed by annual returns are stronger than general average, and more negative returns, better the next year's performance tends to be. In fact, last three times S&P500's annual return has been worse than this year's, the index has returned more than 20% in the following year.

S&P500 closing in 2022 has been made in the 3800 point area: projecting a negative first part of the year (Q1, in extension Q2) a -20% may be extremely likely. Sentiment has shifted to the downside and target area is set between 3,000 and 2,750 index points. Intermediate steps to buy an ETF are 3,500 - 3,300 - 3,100. The arrival of recession, easing of rate hike, and structural selling are on market's ropes at least in the first part of the year. From July onward I think another game can be played with more market movers and some unexpected good news. I expect a positive year but within this year's trading range with a close above 3,800 points. We will be step-by-step specific with a couple of months ahead of schedule with help of time-price, but plotted path we will follow for our clients and within our managements is this. Positive but not too positive.

Dopo un anno negativo

La domanda che tutti si chiederanno è: cosa succede dopo? Nessuno può avere l’arroganza di poter rispondere seriamente a questa domanda. Dentro questa lettera per i traders e gli investitori, spesso abbiamo creato delle previsioni mensili sull’andamento dell’indice tedesco DAX, strutturato trade (ancora in corso), avere una visione di lungo periodo e molto altro. L’avventura intrapresa è stata tutto sommato performante nonostante tutti là fuori siano pronti a lanciare critiche. Io mi limito a farlo quando ho davvero un contributo da offrire, e non farlo tanto per. Lavorare con la statistica a proprio favore è il vero segreto per sopravvivere nella giungla dei mercati finanziari.

Analizzando i singoli rendimenti annuali dell'S&P500 negli ultimi 100 anni, abbiamo riscontrato che, sebbene il -20% circa del rendimento annuale dell'indice appaia storicamente scarso, si tende a vedere un rimbalzo negli anni successivi a cali simili. Detto questo, è difficile trovarne uno che non si sia verificato durante o subito dopo una recessione. E’ giusto sottolineare che gli anni di rendimenti negativi tendono a essere seguiti da rendimenti annuali più forti della media generale e che, quanto più i rendimenti negativi sono negativi, tanto più la performance dell'anno successivo tende a essere migliore. Infatti le ultime tre volte che il rendimento annuale dell'S&P500 è stato peggiore di quello di quest'anno, l’indice ha registrato un rendimento superiore al 20% nell'anno successivo.

La chiusura dell’S&P500 nel 2022 è stata fatta nell’area dei 3800 punti: proiettando una prima parte di anno negativa (Q1, in estensione Q2) un -20% può essere estremamente probabile. Il sentiment è spostato al ribasso e l’area target è posta tra 3,000 e 2,750 punti di indice. Gli step intermedi per acquistare un ETF sono 3,500 - 3,300 - 3,100. L’arrivo della recessione, l’allentamento del rialzo dei tassi e vendite strutturali sono nelle corde del mercato almeno nella prima parte dell’anno. Da Luglio in poi credo che si possa giocare un’altra partita con altri market mover e qualche inattesa buona notizia. Mi aspetto un anno positivo ma dentro il trading range di quest’anno con una chiusura superiore ai 3,800 punti. Saremo specifici passo per passo con un anticipo di un paio di mesi sulla tabella di marcia con l’aiuto del tempo-prezzo, ma la strada tracciata che seguiremo per i nostri clienti e all’interno delle nostre gestioni è questa. Positivi ma non troppo.

2022, an anomalous year

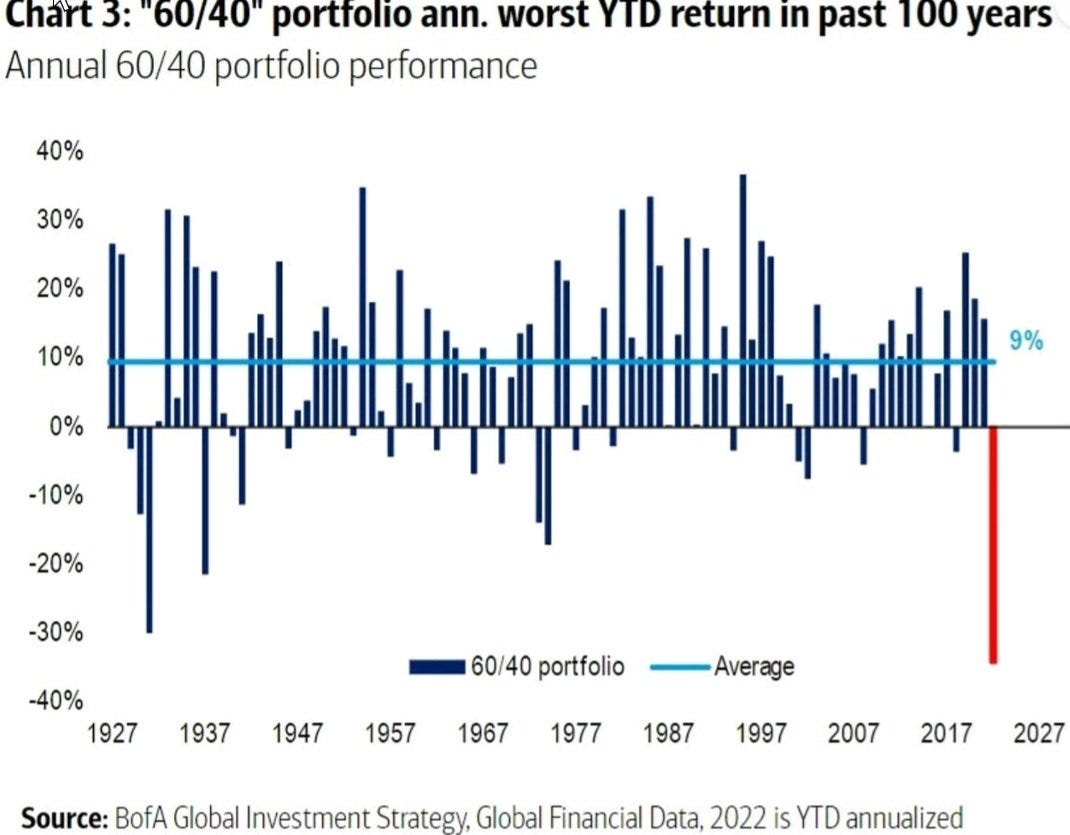

Financial market machine sometimes doesn’t go as it should. There are years when everything works perfectly: correlations, respected maturities, macroeconomic cycles and technical structures. Some years don't. External stresses and cause-and-effect relationship determines the performance of stocks, fluctuations of investors' portfolios sometimes have to fight against the unpredictable. This is what happened to the 60/40 portfolio case study: in the last 100 years, 2022 was the worst ever.

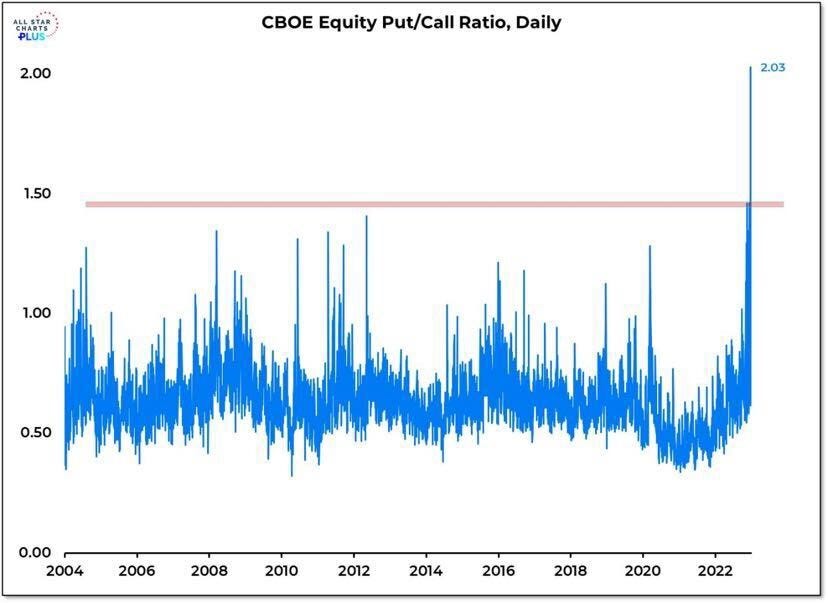

Even CBOE Put/Call ratio was above 2.0 for the first time ever in the last weeks of 2022. A few days ago I took liberty of addressing this topic by calling them broken markets. Federal Reserve's extreme interventions and European Central Bank's change of stance completed a picture already put under pressure by exogenous factors previously mentioned. So is everything black? Absolutely not! 2023 could be one of the greatest buying opportunities of all time, especially when we consider some strategic sectors for the coming years. Asian winds of sacred alliance and ceasefire between India and China could usher in the golden age of shipbuilding. Emerging markets could definitely make the leap forward has always been told and never completed.

What is the put-call ratio? — Put-call ratio is a measure widely used by investors to gauge the general mood of a market. A put option is a right to sell an asset at a predetermined price. A call option is a right to buy an asset at a predetermined price. If traders buy more puts than calls, this signals an increase in bearish sentiment. On the other hand, if they buy more calls than puts, it means they see a bullish market coming. Thus: a put option gives trader the right to sell an asset at a predetermined price while a call option is a right to buy an asset at a predetermined price. Traders who buy more puts than calls indicate a bearish market. On the other hand, if they buy more calls than puts, it is likely to be a bullish market

2022, un anno anomalo

La macchina dei mercati finanziari a volte non va come dovrebbe. Ci sono anni in cui funziona tutto perfettamente: correlazioni, scadenze rispettate, cicli macro-economici e strutture tecniche. Alcuni anni no. Le sollecitazioni esterne e il rapporto causa-effetto che determina l’andamento delle azioni, le fluttuazioni dei portafogli degli investitori a volte devono combattere contro l’imprevedibile. Questo è quello che è successo al case study del portafoglio 60/40: negli ultimi 100 anni, il 2022 è stato il peggiore di sempre.

Anche il rapporto CBOE Put to Call è stato superiore a 2,0 per la prima volta in assoluto nelle ultime settimane del 2022. Alcuni giorni fa mi sono permesso di affrontare questo argomento definendoli mercati rotti. Gli interventi estremi della Federal Reserve e il cambio di stance della Banca Centrale Europea hanno completato un quadro già messo sotto pressione dai fattori esogeni precedentemente accennati. Quindi è tutto nero? Assolutamente no! Il 2023 potrebbe essere una delle più grandi opportunità di acquisto di tutti i tempi, soprattutto se consideriamo alcuni settori strategici per i prossimi anni. I venti asiatici di sacra alleanza e del cessate il fuoco tra India e Cina, potrebbero dar vita all’epoca d’oro della produzione navale. I mercati emergenti potrebbero definitivamente fare il salto di qualità da sempre raccontato e mai completato.

Che cos'è il Put-Call Ratio? — Il put-call ratio è una misura ampiamente utilizzata dagli investitori per valutare l'umore generale di un mercato. Un'opzione put è un diritto a vendere un'attività a un prezzo predeterminato. Un'opzione call è un diritto a comprare un'attività a un prezzo predeterminato. Se i trader acquistano più put che call, questo segnala un aumento del sentiment ribassista. Se invece acquistano più call che put, significa che vedono un mercato rialzista in arrivo. Quindi: un'opzione put conferisce al trader il diritto di vendere un'attività a un prezzo prestabilito mentre un'opzione call è un diritto di acquistare un'attività a un prezzo prestabilito. I trader che acquistano più put che call indicano un mercato ribassista. Se invece acquistano più call che put, è probabile che si tratti di un mercato rialzista.