Are Financial Markets Manipulated?

Markets, economy, liquidity and financial bubbles: big players move their pawns

«I have a clear message for you: within our mandate, the ECB is ready to do whatever it takes to preserve the Euro. And believe me, it will be enough» — Mario Draghi

I don’t want to overload this new letter with expectations. I’m not an economist, but a simple reader who delights in taking in the news, studying charts and analyzing data we are constantly shown every day. I’m an analyst and prefer to stay in my comfort zone, although I admit these are complicated months. What we have been witnessing for the past few weeks are dystonias that I’ve also discussed in some recent articles in Dax Trading Ideas.

Financial markets and economy are two very different things. Sometimes they move closer together, sometimes they move apart like a wave that touches the shore and then turns back. An old stock market saying goes like this, «markets can remain irrational longer than an investor can be solvent». You will basically burn through your money before a stock, a currency, an index, makes its move. After all, timing is critical in a trader's choices, less so for a long-term investor. There are many legitimate questions: how can I predict future performance? With the information at hand, is it possible to find inefficiencies or elements that give us a satisfactory statistical advantage? Is it possible to do this if we are just a drop in the ocean of markets? Is manipulation a truthful concept? If yes, why continue to play the game?

These are the questions that plague everyone involved in finance, from the junior assistant in the institutional trading room to the award-winning economist. I admit my aversion to the latter category, no offense to scholars and graduate students, but substance is very different from the form. Models applied and studied in universities and economics textbooks should be torn up and then rewritten after every financial crash, after every central bank intervention, in short, every day there is a new story to tell completely disproves the previous one. The problem with macroeconomic sacred texts is that what is studied is nothing more than static models, devoid of any kind of personality. An example I can give in this regard is the words of Mario Draghi in 2012 whose anniversary was celebrated with a tone of emphasis.

ECB's was one of the greatest manipulations of the past 30 years: from that moment on, the world's financial markets changed pace. On what book do you anticipate a speech, a statement made with this personality, a change in tone so commanding it would turn markets upside down without moving a finger? For the sake of record, let me inform you that in the years followed nothing of note happened other than the continuation of an accommodative policy began in 2008 in the United States and continued in Europe. If it were so easy to assume inflation up and markets down, believe me, money would fall from the sky straight into your pockets. So what is it that drives markets to constantly reassess? What is wrong or what are we not seeing?

«Ho un messaggio chiaro da darvi: nell'ambito del nostro mandato la Bce è pronta a fare tutto il necessario a preservare l'Euro. E credetemi: sarà abbastanza» — Mario Draghi

Non vorrei caricare eccessivamente di aspettative questa nuova lettera. Non sono un economista, ma un semplice lettore che si diletta nel recepire le notizie, studiare grafici e analizzare i dati che costantemente ci vengono mostrati ogni giorno, di ogni settimana. Sono un analista e preferisco rimanere nella mia comfort zone, anche se ammetto che questi sono mesi complicati. Quello a cui stiamo assistendo da alcune settimane sono delle distonie di cui ho parlato anche in alcuni articoli recenti in Dax Trading Ideas.

I mercati finanziari e l’economia sono due cose molto diverse. A volte si avvicinano, a volte si allontanano come un onda che tocca la riva e poi torna indietro. Un vecchio detto di borsa recita così: «I mercati possono rimanere irrazionali più a lungo di quanto un investitore possa essere solvibile». In pratica brucerai il tuo denaro prima che un titolo, una valuta, un indice, faccia il suo movimento. Dopotutto il timing è fondamentale nelle scelte di un trader, meno per un investitore di lungo termine. La domanda lecite sono molte: come posso fare per predire il futuro andamento? Con le informazioni a disposizione, è possibile trovare inefficienze o elementi che ci diano un vantaggio statistico soddisfacente? E possibile fare questo se noi siamo solo una goccia nel mare dei mercati? La manipolazione è un concetto veritiero? Se si, perchè continuare a giocare?

Questa sono le domande che affliggono tutti quelli che si occupano di finanza, dall’assistente junior in trading room istituzionale fino all’economista pluripremiato. Ammetto la mia avversione a quest’ultima categoria, non me ne vogliano studiosi e laureati ma la sostanza è molto diversa dalla forma. I modelli che vengono applicati e studiati nelle università e sui libri di economia dovrebbero essere strappati e poi riscritti dopo ogni crash finanziario, dopo ogni intervento delle banche centrali, insomma ogni giorno c’è una nuova storia da raccontare che smentisce completamente quella precedente. Il problema dei testi sacri macro economici è che quello che viene studiato non è nient’altro che modelli statici, privi di un qualsiasi tipo di personalità. Un esempio che posso fare in tal senso sono le parole di Mario Draghi nel 2012 la cui ricorrenza è stata festeggiata con tono di enfasi.

Quello della BCE è stato uno delle più grandi manipolazioni degli ultimi 30 anni: da quel momento in poi i mercati finanziari mondiali cambiarono passo. Su quale libro si prospetta un intervento, una dichiarazione fatta con questa personalità, un cambiamento di tono così imponente da rivoltare i mercati senza muovere un dito? Per onore di cronaca vi informo che negli anni successivi nulla è successo di rilevante se non la continuazione di una politica accomodante iniziata dal 2008 negli Stati Uniti e proseguita in Europa. Se fosse così facile ipotizzare inflazione su e mercati giù, credetemi, i soldi cadrebbero dal cielo direttamente nelle vostre tasche. Allora cos’è che spinge i mercati a rivalutare costantemente il tiro? Cosa c’è che non va o che non vediamo?

It's the liquidity, stupid!

Defining what manipulation is, it’s complicated, as there is a real risk of misrepresentation or overloading a movement with negative expectations. In the case of finance, we can say without any duty of denial that markets are manipulated. This seems to be the usual definition for accusing someone or something. For those who see conspiracies everywhere, I'll let you in on a secret: you may be right. If you believe everything that happens on TV, during the release of a quarterly report or the estimation data, you are off the mark. Truth is that everything is built to make us wrong. Wall Street is the casino full of colored lights on, made to order to attract capital from all over the world. This is obvious and blatant and, to be fair, they succeed very well in their intent. Democracy 2.0 in the markets, however, uses a very clear sieve: turns the unwise and foolish away from their money. Financial markets have, since the dawn of time, been the perfect place to do this.

Manipulation is evident at every moment, on the trading books by algorithms, during the release of macro economic data, and at many other times of the day. Markets are cynical, especially at dramatic moments when consciences are deeply touched: see what happened during 9/11 in 2001 or the financial crisis of 2008, the pandemic of 2020, and Feb. 24, 2022, the beginning of the war between Russia and Ukraine. It is precisely in those moments that manipulation pushes harder, attracted by volumes and volatility of psychological mass of investors pushing up and down stocks, commodities and bonds in a continuous game between risk and opportunity.

Supply and demand is the counter of the markets, everything is decided there. External factors, exogenous events collide with the liquidity of hedge funds and the intentions of those who are there to exploit the so-called momentum. Scenario is apocalyptic. There is no data, no market-mover, no single light that can give a shred of hope to lift economies anytime soon. «The next few years are going to be tough as hell», is the message leaking out among insiders and online. And financial markets don't give a damn, cheerfully. But we mere mortals lack the long-term view, what is called the «big picture» in the jargon. Markets look ahead, macro data take pictures of the past, and for institutions that doesn't matter. Or at least it matters little. What matters is confidence, it is the outlook, it is the allocation of money. Liquidity matters, the rest is talk.

È la liquidità, stupido!

Definire cos’è la manipolazione è complicato, in quanto esiste il rischio concreto di travisare il discorso o di caricare eccessivamente di aspettative negative un movimento. Nel caso della finanza, possiamo affermare senza dovere di smentita che i mercati sono manipolati. Sembra essere la solita definizione per accusare qualcuno o qualcosa. Per chi vede complotti ovunque vi svelo un segreto: potreste avere ragione. Se credete a tutto quello che succede alla TV, durante l’uscita di una trimestrale o la stima di un dato, siete fuori strada. La verità è che tutto è costruito per farci sbagliare. Wall Street è il casinò con tante luci colorate accese, fatto a regola d’arte per attrarre capitali da tutto il mondo. Questo è evidente e palese e, ad onor del vero, riescono benissimo nel loro intento. La democrazia 2.0 dei mercati però utilizza un setaccio molto chiaro: allontana gli sprovveduti e gli stolti dai loro denari. I mercati finanziari sono, fin dalla notte dei tempi, il luogo perfetto per fare questo.

La manipolazione è evidente in ogni istante, sui book di negoziazione da parte degli algoritmi, durante il rilascio di un dato macro economico, e in molti altri momenti della giornata. I mercati sono cinici, soprattutto nei momenti drammatici in cui le coscienze vengono toccate profondamente: vedete cosa è successo durante l’11 Settembre del 2001 oppure la crisi finanziaria del 2008, la pandemia del 2020 e il 24 Febbraio 2022, inizio della guerra tra Russia e Ucraina. E’ proprio in quei momenti che la manipolazione spinge più forte, attratta dai volumi e dalla volatilità della massa psicologica degli investitori che spinge su e giù titoli, materie prime e obbligazioni, in un gioco continuo tra rischio e opportunità.

La domanda e l’offerta è il banco dei mercati, tutto si decide lì. I fattori esterni, gli eventi esogeni si scontrano con le liquidità degli hedge funds e con le intenzioni di chi è li per sfruttare il cosiddetto momentum. Lo scenario è apocalittico. Non c’è un dato, un market-mover, una sola luce che possa dare un briciolo di speranza per risollevare le economie in tempi brevi. «I prossimi anni saranno durissimi» è il messaggio che trapela tra gli addetti ai lavori e in rete. E i mercati finanziari se ne fregano, allegramente. Ma a noi comuni mortali manca la visione di lungo periodo, quella che in gergo viene definita «big picture». I mercati guardano avanti, i dati macro fotografano il passato e per le istituzioni quello non conta. O almeno conta poco. Quello che conta è la fiducia, sono le prospettive, è l’allocazione di denaro. La liquidità conta, il resto sono chiacchiere.

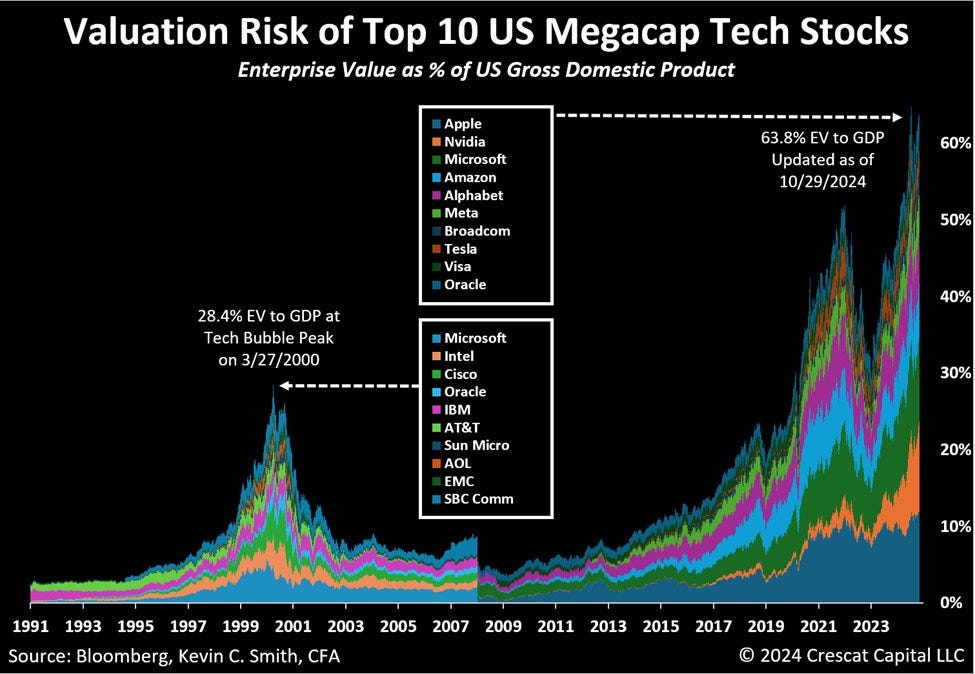

The liquidity bubble

We live in times where the cost of money is trending upward, but actually if we look closely and realize that we are coming from 30 years of devaluations: what we have in our pockets and accounts is waste paper. The misunderstanding must be solved (according to the markets' thesis, ed.) by continuously allocating liquidity to the best performing sectors and stocks. This is how the fairy tale of big tech was born in the United States. That’s how all big bubbles are born. No one will ever know what day will be when the Pandora's box will be uncovered, who will pierce this big money-eating machine with a pin: truth is that markets while affected by many exogenous factors of 2022, are thirsty for liquidity.

If you just look back and think for a single moment about the pandemic, lockdowns, Russian invasion, trade wars, who among us could possibly think that things could get better and not worse? The markets, clearly. The game must go on, liquidity will continue to flow, cash will continue to flow, as will the blood in the streets. This is not the saga of platitudes but just a moment of reflection I wanted to share in this episode. Sometimes we are too blinded by our ideas, expectations and positions that we try to structure, looking at the finger and not the moon.

Solar system of markets will continue to spin. It will not disappear. There will always be something under-priced in value and something in a bubble will burst, but the thing needs to be made clear once and for all is that markets do not need past data to move but they do need wealthy investors ready to jump into the fire. The flame burns with new players; we are the ones who fuel it.

La bolla della liquidità

Viviamo in tempi dove il costo del denaro tende al rialzo ma in realtà se osserviamo bene ci rendiamo conto che veniamo da 30 anni di svalutazioni: quello che abbiamo nelle tasche e sui nostri conti è carta straccia. L’equivoco va risolto (secondo la tesi dei mercati, ndr), allocando continuamente liquidità nei settori e sui titoli più performanti. E’ così che è nata la favola delle big tech negli Stati Uniti. E’ così che nascono tutte le grandi bolle. Nessuno saprà mai quale sarà il giorno in cui il vaso di pandora verrà scoperchiato, chi bucherà con uno spillo questa grande macchina mangia soldi: la verità è che i mercati seppur colpiti dai tanti fattori esogeni del 2022, hanno sete di liquidità.

Se solo vi guardate indietro e pensate per un solo istante alla pandemia, ai lockdown, all’invasione russa, alle guerre commerciali, chi di noi potrebbe minimamente pensare che le cose possano andare meglio e non peggio? I mercati, chiaramente. Il gioco deve continuare, la liquidità continuerà a fluire, il contante continuerà a circolare, così come il sangue per le strade. Non è la saga dei luoghi comuni ma soltanto un momento di riflessione che volevo condividere in questo episodio. A volte siamo troppo abbagliati dalle nostre idee, dalle aspettative e dalle posizioni che cerchiamo di strutturare, guardando il dito e non la luna.

Il sistema solare dei mercati continuerà a girare. Non scomparirà. Ci sarà sempre qualcosa di valore sotto-prezzato e qualcosa in bolla che scoppierà, ma la cosa che va chiarita una volta per tutte è che i mercati non hanno bisogno dei dati passati per muoversi ma hanno bisogno di investitori danarosi pronti a lanciarsi nel fuoco. La fiamma arde con i nuovi giocatori, siamo noi che la alimentiamo.